Table of Content

When you buy, sell or refinance a home, closing costs are a pricey part of the transaction. And while most taxpayers should take the standard deduction over itemizing deductions on their income taxes to maximize savings, the year you purchase or refinance a home may be an exception. Although points and prepaid interest sound like the same thing, they are often listed separately on the HUD-1 Settlement Statement. Points are prepaid interest over the life of the loan, while "prepaid interest" refers to the interest just for the first partial-month of your loan.

In the year paid, you can deduct $1,750 ($750 of the amount you were charged plus the $1,000 paid by the seller). You spread the remaining $250 over the life of the mortgage. You must reduce the basis of your home by the $1,000 paid by the seller.

Are Home Closing Costs Tax Deductible?

If so, use the rules in this section to find how much of it, if any, you can deduct. Send tax questions, tax returns, or payments to the above address. Discharges of qualified principal residence indebtedness. Mortgage Insurance PremiumsQualified Mortgage InsuranceAllocation of prepaid mortgage insurance premiums.

Make a payment or view 5 years of payment history and any pending or scheduled payments. Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. You put wall-to-wall carpeting in your home 15 years ago. Later, you replaced that carpeting with new wall-to-wall carpeting. The cost of the old carpeting you replaced is no longer part of your home's adjusted basis.

How To File An Extension On Tax Return

Of course, the higher the basis of the property, the more your depreciation expense each year will be—and the higher your depreciation, the lower your taxable income from your rental property will be. Deprecation can be a huge tax savings for those who own rental property. An asset is depreciated over the term of its “useful life,” as defined by the internal revenue service. For example, your rental property is likely going to have a much longer useful life compared to your car simply because it is real property.

You can also fully deduct in the year paid points paid on a loan to substantially improve your main home if you meet the first six tests listed earlier. You can't deduct the full amount of points in the year paid. They are prepaid interest, so you must generally deduct them over the life of the mortgage. If you pay interest in advance for a period that goes beyond the end of the tax year, you must spread this interest over the tax years to which it applies. Generally, you can deduct in each year only the interest that qualifies as home mortgage interest for that year. Most home buyers take out a mortgage to buy their home.

Closing costs that can be deducted over the life of your loan

Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one.

The MCC will show the certificate credit rate you will use to figure your credit. It will also show the certified indebtedness amount. Only the interest on that amount qualifies for the credit. The allocation rules, explained above, do not apply to qualified mortgage insurance provided by the Department of Veterans Affairs or Rural Housing Service. Form 1098line 8b.points not reported on Form 1098line 8c.qualified mortgage insurance premiumsline 8d. The buyer must also reduce the basis of the home by the amount of the seller-paid points.

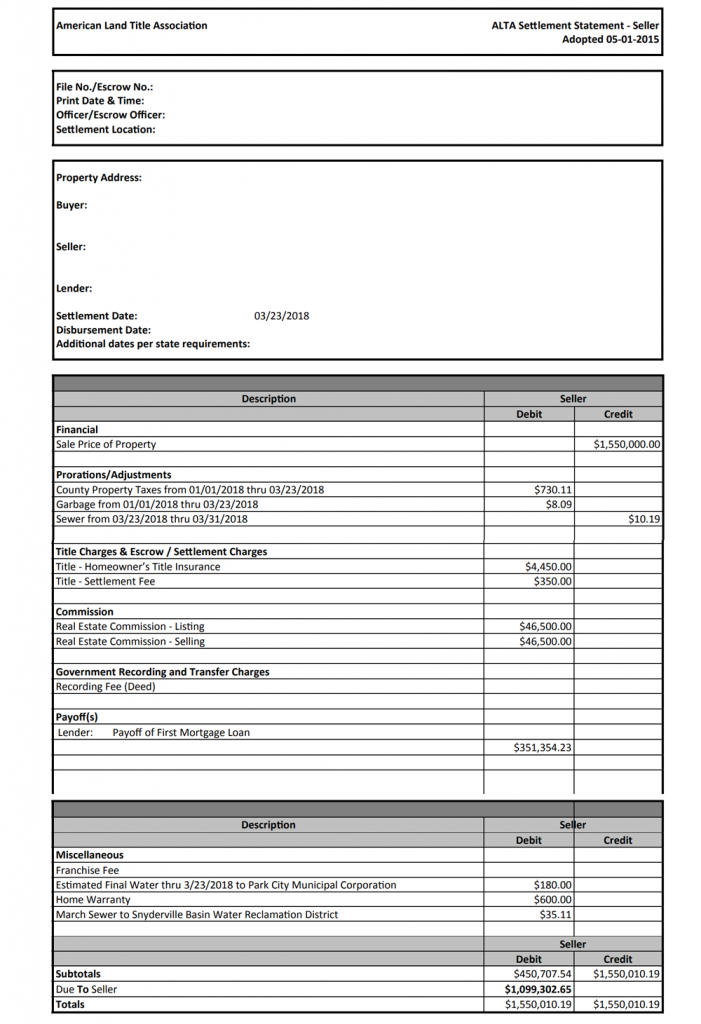

Therefore, you actually deduct the closing costs over time, rather than deducting most of them immediately when you purchase the real estate. You can include in your basis the settlement fees and closing costs you paid for buying your home. A fee is for buying the home if you would have had to pay it even if you paid cash for the home. You can't deduct these amounts as points either in the year paid or over the life of the mortgage. For information about the tax treatment of these amounts and other settlement fees and closing costs, see Basis, later.

You can lower your potential capital gains tax bill by doing this. Should you itemize deductions or take the standard deduction? Both lower your taxes, but the key is finding which one lowers your bill the most. The deductions for taxes, mortgage interest and PMI remain the same whether you’re refinancing or buying a new house. But wait—if you can deduct mortgage interest, that means you borrowed money to buy a rental. If you’re not in the position to pay cash for a rental, don’t buy it.

See your Cardholder Agreement for details on all ATM fees. See Online and Mobile Banking Agreement for details. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

Before closing, discuss the details of these costs with your lender and find out if they are willing to offer you a loan with lower fees. Mortgage points can be deducted over the course of the loan if desired. It’s possible that there will be some years where taking the standard deduction is preferable to doing so much more expensively by itemising. In that case, you can put off taking advantage of the points deduction until you’re in an itemised tax bracket. Home repairs are not deductible but home improvements are. If you use your home purely as your personal residence, you obtain no tax benefits from repairs.

When you sell a personal residence, closing costs, such as attorney and realtor fees, are not tax deductible. Just as when you are a purchaser, most closing costs are not tax write-offs. On the plus side, you may add these expenses to the cost basis of your home, which minimizes any capital gains tax requirements. Escrow is an arrangement whereby a portion of your monthly mortgage payment is set aside and used to pay annual expenses like property taxes and homeowner’s insurance. Your lender will use these reserves to make payments on your behalf, such as annual insurance and tax premiums. Any real estate taxes paid ahead of time are eligible for a tax write-off come April.

You can't include in basis the value of your own labor or any other labor for which you didn't pay. If you refinance your original mortgage loan on which you had been given an MCC, you must get a new MCC to be able to claim the credit on the new loan. The amount of credit you can claim on the new loan may change.

No comments:

Post a Comment